My 2020 overview

1. Freelance career

Our results in life are a direct reflection of our choices. If you want better results, make better choices. Make different choices.

After about 6.5 years at one and only one company, I decided to move on and quit. It is not a big company but allowed me to develop cool products. I am thankful for the experience and knowledge I gained from our team.

There are 2 reasons why I did it - leave comfort zone and find a stronger team. That should help me become better. Not better than others. Better than yesterday!

I started my freelance career in late spring, allowing me to accomplish one of my goals that I had set at the outset of 2020, when I was travelling home for my fathers's birthday.

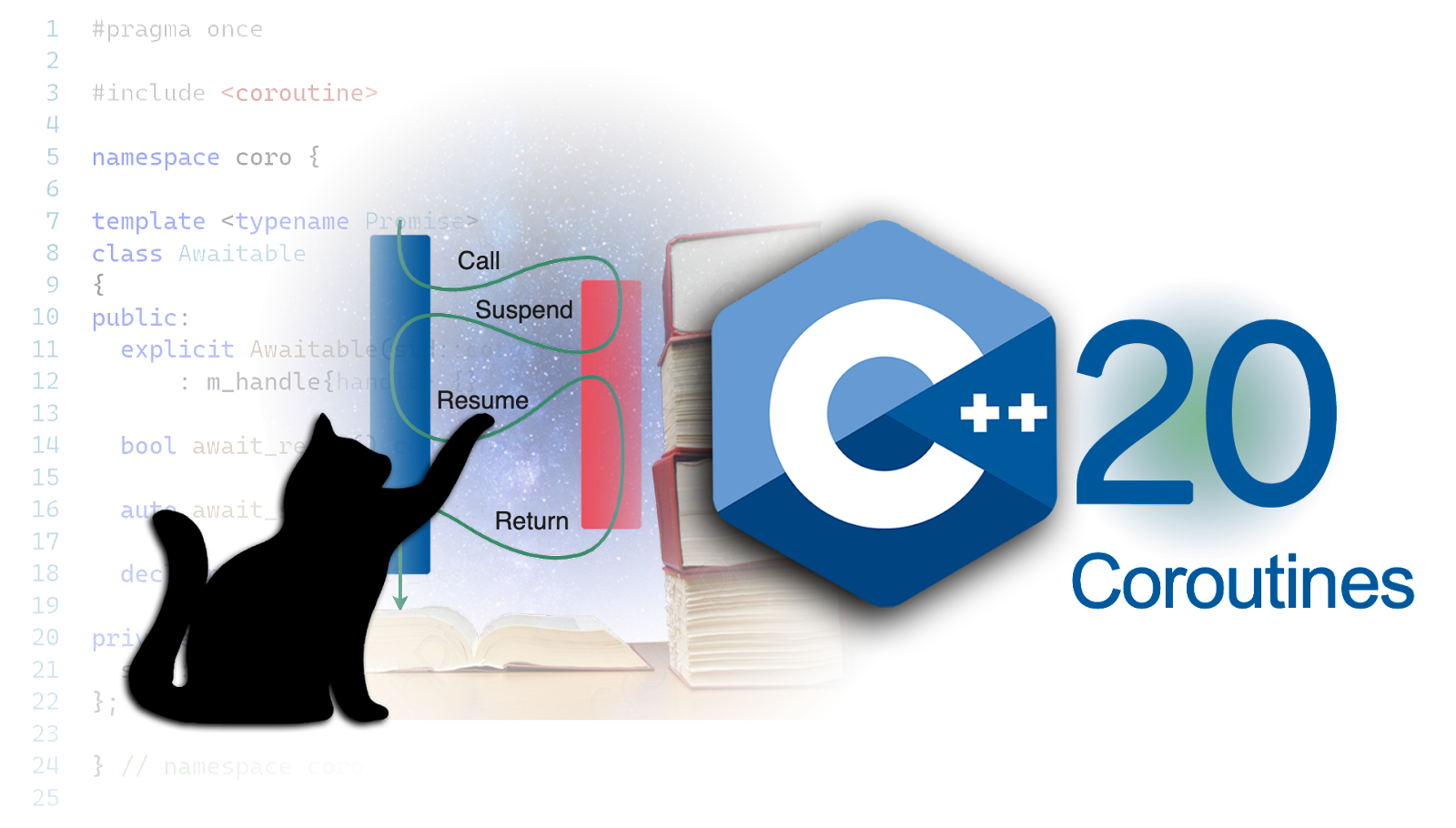

It is not easy to start a freelance career, but if you have some management experience and pretty good experience with web (React and Node) and desktop (mainly C and C++) languages and technologies you will find work easily. I am not super talented but I know for sure that I always do all of my work as well as possible. There is one important principle I stick to - keep it simple!

2. Investment account

An investment operation is one which, upon thorough analysis promises safety of principal and an adequate return.

Benjamin Graham, "The Intelligent Investor"

My financial journey began in 2017, when I started to control my incomes and expenses via Money OK app. I also started reading financial independence books and watching stocks market news. In 2020, I finally did it! I bought my first stocks and ETFs.

Now I combine Money OK and Numbers for better visualisation and precision. Here is my financial breakdown for 2020:

I would like to highlight one particular book - John C. Bogle, "The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns".

Investing is all about common sense. Owning a diversified portfolio of stocks and holding it for the long term is a winner’s game. Trying to beat the stock market is theoretically a zero-sum game. Common sense tells us - and history confirms - that the simplest and most efficient investment strategy is to buy and hold all of the nation’s publicly held businesses at very low cost. The classic index fund that owns this market portfolio is the only investment that guarantees you with your fair share of stock market returns.

That is why the majority of my account is ETFs (more than 70%). It is less risky and provides good returns for beginners.

Last but not least, the current result looks like:

3. Psychology

Rule your mind or it will rule you.

Horace

During the lockdown I had time to discover something new so I decided to start reading about psychology and meditation.

Psychology is a great way to learn more about yourself and others that is why I started going to a psychologist at the age of 29. I found out that psychotherapy helped me to improve self-confidence.

Even though I still try to figure out the most helpful technique for meditation, I know for sure - it helps me to increase focus, reduce stress, and promote calmness.

Addons

Best book I read in 2020 - Ray Dalio, "Principles: Life and Work".

Comments

Post a Comment